Tax smoothing is intended to ________

A) reduce income inequality

B) avoid fluctuations in the ratio of the government deficit to GDP

C) shift the burden from current taxpayers onto future generations

D) keep the tax wedge from shrinking

C

You might also like to view...

As word processing on personal computers expanded, sales of typewriters began to disappear. Which of Porter's competitive forces does this event demonstrate?

A) bargaining power of buyers B) bargaining power of suppliers C) competition from substitute goods or services D) the threat of competition from new entrants

A government spending and taxation policy to achieve macroeconomic goals is known as:

a. countercyclical policy. b. fiscal policy. c. monetary policy. d. a balanced budget. e. presidential discretion.

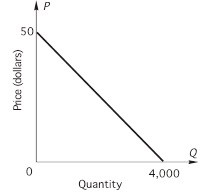

According to the following figure, the equation for marginal revenue is

A. MR = 50 - 160Q. B. MR = 4,000 - 100Q. C. MR = 4,000 - 2,000Q. D. MR = 50 - 0.025Q. E. none of the above

Which of the following is an example of a capital-intensive commodity?

A. Clothing. B. Wool. C. Sunflower seeds. D. Chemicals.