If the government wants to raise tax revenue and shift most of the tax burden to the sellers it would impose a tax on a good with a:

A. flat (elastic) demand curve and a steep (inelastic) supply curve.

B. steep (inelastic) demand curve and a flat (elastic) supply curve.

C. steep (inelastic) demand curve and steep (inelastic) demand curve.

D. flat (elastic) demand curve and a flat (elastic) supply curve.

Answer: A

You might also like to view...

The adverse supply shocks experienced during the 1970s strengthened the Philips Curve relationship between inflation and unemployment

Indicate whether the statement is true or false

Which of the following is a goal of a welfare system?

A. To make recipients happy B. To reduce the number of children born C. To provide an adequate standard of living D. None of the above

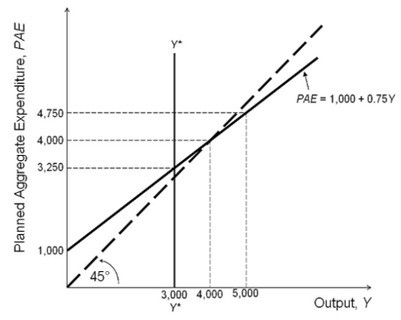

Refer to the accompanying figure. Based on the Keynesian cross diagram, at short-run equilibrium output autonomous expenditure equals ________ and induced expenditure equals ________.

Based on the Keynesian cross diagram, at short-run equilibrium output autonomous expenditure equals ________ and induced expenditure equals ________.

A. 3,000; 4,000 B. 4,000; 2,000 C. 1,000; 4,000 D. 1,000; 3,000

According to the quantity theory of money and prices, a 10 percent increase in the money supply ultimately leads to

A. a 10 percent increase in wages. B. a 10 percent increase in real Gross Domestic Product (GDP). C. a 10 percent increase in the price level. D. a 10 percent decrease in velocity.