A hedge is

A) a financial strategy that reduces the change of suffering losses arising from foreign exchange risk.

B) an exchange rate arrangement in which a country pegs the value of its currency to the exchange value.

C) the possibility that changes in the value of a nation's currency will result in variations in the market value of assets.

D) active management of a floating exchange rate on the part of a country's government.

Answer: A

You might also like to view...

Refer to Table 4-14. The equations above describe the demand and supply for Pauline's Pickled Pomegranates. The equilibrium price and quantity for Pauline's Pickled Pomegranates are $30 and 15 thousand units. What is the value of consumer surplus?

A) $50 thousand B) $112.5 thousand C) $225 thousand D) $337.5 thousand

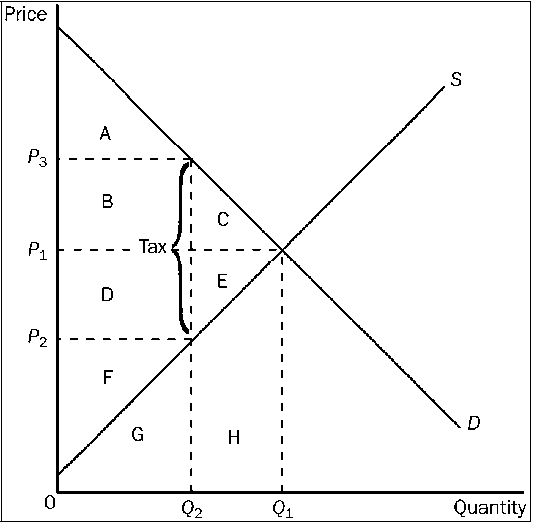

Figure 4-25

Refer to . Producer surplus before the tax was levied is represented by area

a.

A.

b.

A + B + C.

c.

D + E + F.

d.

F.

A real interest rate that causes the quantity of saving supplied to be equal to the quantity of saving (or investment) demanded is an example of the:

A. principle of comparative advantage. B. equilibrium principle. C. principle of increasing opportunity cost. D. scarcity principle.

It is estimated that a 3 percent drop in the price of Asian and European cars will decrease the demand for American cars by 0.84 percent. From this information one can conclude that:

A. the income elasticity of demand for American cars is less than 1. B. European and Asian cars are complements for American cars. C. European and Asian cars are substitutes for American cars. D. European and Asian cars are luxuries.