The tax fully dedicated to provide support for Medicare Part A is:

a. a tax on the health insurance premiums paid for all group plans.

b. a 2.9 percent payroll tax paid by all workers, regardless of their age.

c. the federal income tax.

d. levied on the Medicare Trust Fund.

e. the mandate tax paid by individuals who do not purchase health insurance.

b. a 2.9 percent payroll tax paid by all workers, regardless of their age.

You might also like to view...

Since the mid-1970s, compared to the United States, European unemployment rates are/is

A. higher. B. much lower. C. about the same as in the United States. D. not compared to the United States, because there are no unemployed in Europe

Which of the following statements about the Coase theorem is true?

a. Underlying the results of the Coase theorem is the idea that private parties can bargain without cost over the allocation of resources. b. The Coase theorem asserts that private solutions to externalities invariably lead to inefficient allocations of resources. c. The Coase theorem applies to negative externalities, but not to positive externalities. d. All of the above are correct.

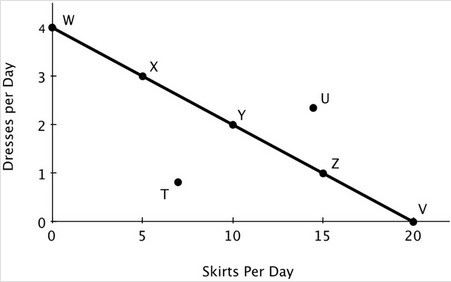

The accompanying figure shows Becky's daily production possibilities curve for dresses and skirts. Of the labeled points, only ________ are attainable.

Of the labeled points, only ________ are attainable.

A. W, X, Y, Z, and V B. X, Y, and Z C. W, X, Y, Z, V, and T D. T and U

Price discrimination is when a firm charges:

A. the same price to all consumers. B. different prices for different goods to different consumers. C. different prices for the same goods to different consumers. D. None of these is correct.