For this question, assume that the economy is initially operating at the natural level of output. A reduction in taxes will cause

A) an increase in the real wage in the medium run.

B) a reduction in the real wage in the medium run.

C) no change in the nominal wage in the medium run.

D) ambiguous effects on the real wage in the medium run.

E) none of the above

E

You might also like to view...

The sensitivity of bank capital to market interest rates is measured by

A) gap analysis. B) duration analysis. C) leverage ratio. D) capital analysis.

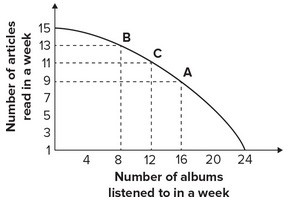

Given the production possibility curve shown below, the opportunity cost of listening to each additional album when moving from point B to point A is on average:

A. 1 article. B. 3 articles. C. 2 articles. D. 1/2 article.

For a good that is taxed, the area on the relevant supply-and-demand graph that represents government's tax revenue is

a. smaller than the area that represents the loss of consumer surplus and producer surplus caused by the tax. b. bounded by the supply curve, the demand curve, the effective price paid by buyers, and the effective price received by sellers. c. a right triangle. d. a triangle, but not necessarily a right triangle.

In 1820, the country with the highest per capita GDP was

A) Australia. B) the United States. C) Austria. D) Germany. E) the Netherlands.