The federal income tax is designed to

A. Shift the Lorenz curve inward.

B. Decrease vertical equity.

C. Raise the Gini coefficient.

D. Shift the Lorenz curve outward.

Answer: A

You might also like to view...

A government's policy of redistributing income makes the income distribution

a. more equal, distorts incentives, alters behavior, and makes the allocation of resources more efficient. b. more equal, distorts incentives, alters behavior, and makes the allocation of resources less efficient. c. less equal, distorts incentives, alters behavior, and makes the allocation of resources more efficient. d. less equal, distorts incentives, alters behavior, and makes the allocation of resources less efficient.

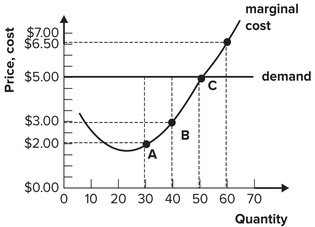

Refer to the graph shown. Currently, if this perfectly competitive firm is maximizing profit, the market price is:

A. $5.00 and marginal revenue for the firm is $3.00 B. $5.00 and marginal revenue for the firm is $5.00 C. $6.50 and marginal revenue for the firm is $6.50 D. $6.50 and marginal revenue for the firm is $5.00

Other nations had tried economic union in the past, and since adopting a common currency had shown economic benefits for them, the nations of Europe decided to try it too

Indicate whether the statement is true or false

According to Okun's law, when cyclical unemployment is positive, the output gap:

A. equals zero. B. is positive. C. equals the rate of cyclical unemployment. D. is negative.