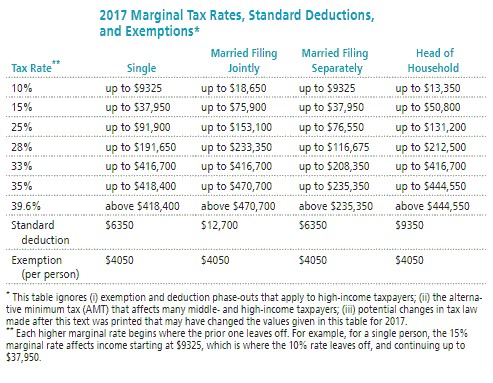

Solve the problem. Refer to the table if necessary. Kelsey earned $58,750 in wages. Conner earned $58,750, all in dividends and long-term capital gains. Calculate the overall tax rate for each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

Kelsey earned $58,750 in wages. Conner earned $58,750, all in dividends and long-term capital gains. Calculate the overall tax rate for each, including both FICA and income taxes. Assume they are both single and take the standard deduction. Note that long-term capital gains and dividends are taxed at 0% for income in the 10% and 15% tax brackets and at 15% for income in all higher tax brackets except the highest 39.6% bracket. If necessary, round values to the nearest dollar.

A. Kelsey: 0.0%

Conner: 4.4%

B. Kelsey: 19.7%

Conner: 11.6%

C. Kelsey: 13.3%

Conner: 2.7%

D. Kelsey: 21.0%

Conner: 2.7%

Answer: D

You might also like to view...

Jackie's parents loaned her $80,000 to fund her college education. Her parents are not charging interest. They desire to be paid one lump sum of $80,000 when Jackie can accumulate that amount. Jackie established a savings plan that earns 8% compounded annually. Her new job promises to pay an annual holiday bonus that will enable her to make equal annual, year-end deposits of $6,400. Approximately how many years will it take Jackie to accumulate the $80,000?

A. 8 years B. 8.5 years C. 9 years D. 12.5 years

Write the first five terms of the geometric sequence with the given first term a and common ratio r.a = 4; r = 5

A. 4, 9, 14, 19, 24 B. 20, 100, 500, 2500, 12,500 C. 5, 20, 80, 320, 1280 D. 4, 20, 100, 500, 2500

Evaluate.10a, for a = 10

A. 99 B. 100 C. 101 D. 20

Freud and Erikson agreed that development is relatively complete by adolescence.

Answer the following statement true (T) or false (F)