Suppose you obtain a fixed rate mortgage during a period of relatively high inflation. During the next ten years, inflation falls. Are you a winner or a loser due to inflation? Explain why

What will be an ideal response?

You would be a loser under this scenario. Your mortgage rate is the sum of the real rate of interest plus the amount of inflation that was expected over the life of the mortgage. When inflation is high, people's expectations of future inflation are high. In those circumstances, your fixed mortgage rate contains a high expected-inflation premium. Therefore, as inflation falls, the real rate of interest on your mortgage increases.

You might also like to view...

A consumer has a monthly income of $100 that he wants to spend on two goods: rugs priced at $10 and chairs priced at $5

What is the consumer's opportunity cost of buying a rug? What is his opportunity cost of buying a chair? Use a table to represent the consumer's budget constraint.

Figure 7-8

A. 1 B. 2 C. 3 D. 4

If government purchases are $400 million, taxes are $700 million, and transfers are $200 million, which of the following is true?

A) Public saving is $500 million. B) The budget deficit is $100 million. C) The budget deficit is $500 million. D) Public saving is $100 million.

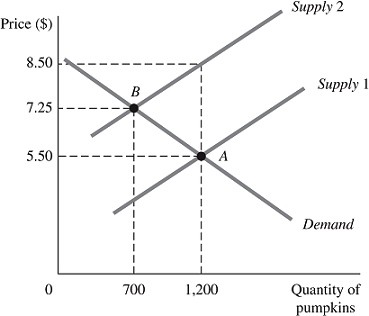

Refer to the information provided in Figure 5.7 below to answer the question(s) that follow.

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Before the tax, store owners are willing to sell ________ pumpkins at a price of ________ each.

Figure 5.7The above figure represents the market for pumpkins both before and after the imposition of an excise tax, which is represented by the shift of the supply curve.Refer to Figure 5.7. Before the tax, store owners are willing to sell ________ pumpkins at a price of ________ each.

A. 1,200; $5.50 B. 1,200; $8.50 C. 700; $7.25 D. 0; $8.50