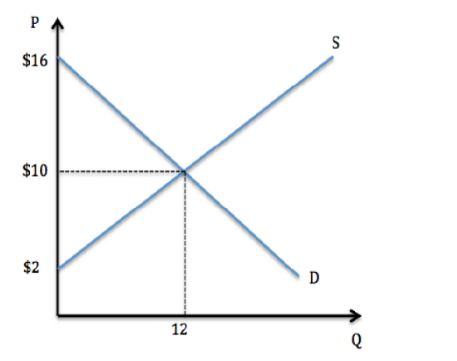

Assume the market was in equilibrium in the graph shown. If the market price were set to $6, which of the following is true?

A. For those still interacting in the market, some surplus is transferred from buyer to seller.

B. For those still interacting in the market, some surplus is transferred from seller to buyer.

C. Producers gain the surplus of those buyers who dropped out of the market.

D. Consumers gain the surplus of those sellers who dropped out of the market.

B. For those still interacting in the market, some surplus is transferred from seller to buyer.

You might also like to view...

Comparing the short-run Phillips curve and the long-run Phillips curve, we see that there is

A) no relationship between the two curves. B) no tradeoff in either curve. C) a tradeoff in both curves. D) only a long-run tradeoff between inflation and unemployment but not a short-run tradeoff. E) only a short-run tradeoff between inflation and unemployment but not a long-run tradeoff.

In the 1980s, expansionary fiscal policy is believed to have crowded out

A) domestic investment as interest rates rose. B) exports and imports as interest rates rose. C) exports but not domestic investment as interest rates rose. D) domestic investment as interest rates fell.

When negative externalities exist in a market, if the producers are forced to pay a Pigouvian tax then:

A. those who interact in the market will gain surplus. B. producers will gain surplus. C. those who do not interact in the market but are affected by the externality will lose surplus. D. those who interact in the market will lose surplus.

Which of the following contributed the most to the economic stability and strong growth of real GDP during the 1980s and 1990s?

a. the rapid growth of government expenditures throughout most of the period b. congressional policies that persistently balance the budget c. modifications in fiscal policy that stimulated aggregate demand during economic slowdowns and restrained it during periods of economic boom d. Federal Reserve policies that kept the inflation rate low and relatively stable