When Bayou Corporation was formed on January 1, 20xx, the corporate charter provided for 100,000 share of $10 par value common stock. The following transaction was among those engaged in by the corporation during its first month of operation: The corporation issued 9,000 shares of stock at a price of $23.00 per share. The entry to record the above transaction would include a

A) debit to Cash for $90,000

B) credit to Common Stock for $207,000

C) credit to Paid in Capital in Excess of Par- for $117,000

D) debit to Common Stock for $90,000

C

You might also like to view...

Which of these documents would not qualify as primary research?

A) A recent survey of your company's top clients B) The most recent issue of a trade magazine in your industry C) Notes from a conversation you recently had with a local government official D) Your company's latest balance sheet E) Current budget figures

Brockney Inc. bases its manufacturing overhead budget on budgeted direct labor-hours. The variable overhead rate is $8.60 per direct labor-hour. The company's budgeted fixed manufacturing overhead is $107,970 per month, which includes depreciation of $9,760. All other fixed manufacturing overhead costs represent current cash flows. The July direct labor budget indicates that 6,100 direct labor-hours will be required in that month.Required:a. Determine the cash disbursements for manufacturing overhead for July.b. Determine the predetermined overhead rate for July.

What will be an ideal response?

A Cost Management System (CMS) is never "complete"

Indicate whether the statement is true or false

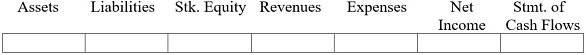

Use the information below to answer the following question(s):Indicate how each event affects the elements of financial statements. Use the following letters to record your answer in the box shown below each element. You do not need to enter amounts.Increase = I Decrease = D No Effect = NAGable Company collected a receivable due from a credit card transaction company; the credit card fee had previously been recognized when the sale was recorded. Show the effect of the collection of the receivable on Gables financial statements.

What will be an ideal response?