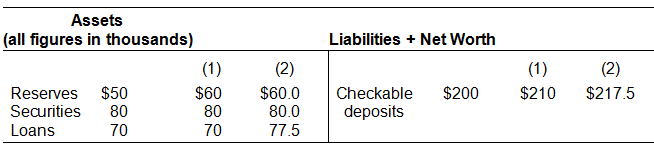

If the balance sheet below were for the entire banking system instead of just a single bank, by how much could loans be expanded? Assume a reserve ratio of 33%.

The system as a whole could support up to $30,000 in new loans. If there were no leakages, the $10,000 in excess reserves would be in the system as if the system were one gigantic bank. As long as those reserves are in the system they must equal 33% of new loans. $10,000 is 33% of $30,000. Therefore, $30,000 worth of new loans can be created in the system with $10,000 of excess reserves. (The monetary multiplier is 1/.333 or 3; 3 times $10,000 = $30,000.) Check able deposits would then become $180,000 and actual reserves of $60,000 would just meet the legal requirement.

You might also like to view...

Commercial banks create new money:

A. by issuing checks. B. when they increase their desired reserve/deposit ratio. C. when they buy government bonds from the Federal Reserve. D. through multiple rounds of lending.

________ is (are) the endogenous variable(s) in the Phillips curve

A) Expected inflation B) Inflation C) The natural rate of unemployment D) all of the above E) none of the above

Macroeconomics focuses on the behavior of

A. Government agencies. B. The overall economy. C. Individual consumers. D. All of the choices are correct.

The assumption that "other things are constant" is also known as the

A) ceteris paribus assumption. B) rational self-interest assumption. C) distinguishing characteristic of economics as a science. D) relationships assumption.