Which of the following is NOT a reason a firm might experience economies of scale?

A) specialization

B) dimensional factors

C) increasing long-run average costs

D) more productive equipment

Answer: C

You might also like to view...

The loanable funds market is also referred to as the:

A) spot market. B) credit market. C) exchange market. D) capital market.

Assume that a British investor buys a one-year U.S. Treasury bill that pays 6 percent annual interest. Given a yield of 4 percent on a comparable British Treasury bill, the U.S. dollar must depreciate 2 percent against the British pound during the year for interest rate parity to hold

a. True b. False Indicate whether the statement is true or false

Historically, development of a new technology often:

A. results in immediate increases in productivity. B. leads to increases in productivity only once firms learn how to use it. C. requires a complementary increase in physical and human capital. D. has had no impact on changes in productivity.

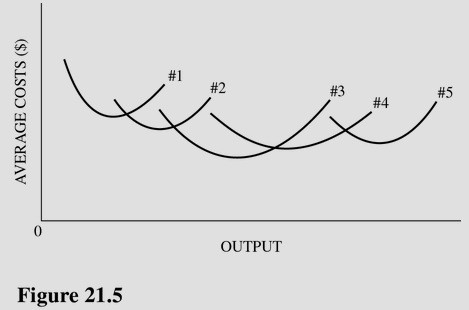

Refer to Figure 21.5. Economies of scale occur in the following range of factory sizes

A. #3 only. B. #1 through #3. C. #1 through #5. D. #1 to #2.