Income effects are negative for normal goods, and positive for inferior goods.

Answer the following statement true (T) or false (F)

False

Rationale: Income effects are positive for normal goods and negative for inferior goods.

You might also like to view...

In the figure above, if no one owns the lake, at the equilibrium quantity what is the marginal social cost of producing the pesticide?

A) $80 B) $40 C) $60 D) $30

Is there a difference between the "true burden" of a tax and who is legally required to pay a tax? Briefly explain

What will be an ideal response?

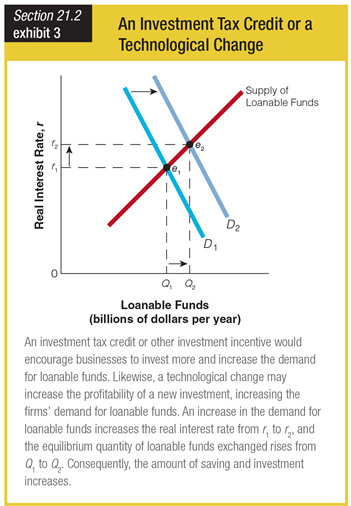

Based on the graph showing the effects of an investment tax credit or a technological change, eliminating an investment tax credit would ______.

a. create a higher equilibrium quantity of saving and investment

b. create a lower equilibrium quantity of saving and investment

c. have no influence on the equilibrium quantity of saving and investment

d. drive the equilibrium quantity of saving and investment to zero

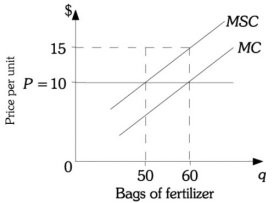

Refer to the information provided in Figure 16.1 below to answer the question(s) that follow.  Figure 16.1 Refer to Figure 16.1. The ________ imposed as a result of producing the market (unregulated) level of fertilizer is $300.

Figure 16.1 Refer to Figure 16.1. The ________ imposed as a result of producing the market (unregulated) level of fertilizer is $300.

A. marginal private cost B. total damage C. marginal social cost D. tax