Ms. Lane borrowed $1,000 from her bank for one year at an interest rate of 10 percent. During that year, the price level went up by 15 percent. Which of the following statements is correct?

a. Ms. Lane will repay the bank fewer dollars than she initially borrowed.

b. Ms. Lane's repayment will give the bank less purchasing power than it originally loaned her.

c. Ms. Lane's repayment will give the bank greater purchasing power than it originally loaned her.

d. Ms. Lane's repayment will give the bank the same purchasing power that it originally loaned her.

b

You might also like to view...

A fixed exchange rate is:

a. determined by the forces of supply and demand. b. the value of a nation's money in gold. c. the value of a nation's money determined by the World Bank. d. none of these.

_____ gains when the U.S. dollar appreciates

a. A U.S. exporting firm b. A foreign tourist in the United States c. A U.S. investor investing abroad d. A foreign investor in the United States

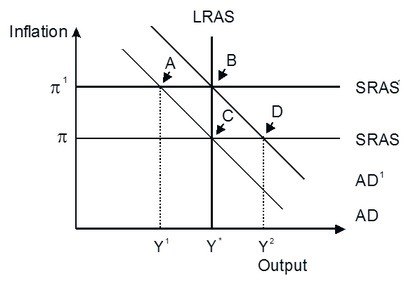

Refer to the accompanying figure. An economy is currently in long-run equilibrium at point B, at an inflation rate of ?', which is too high for to sustain economic growth. If an anti-inflationary policy is enacted, the economy will be in short-run equilibrium at point ________ creating ________ gap.

An economy is currently in long-run equilibrium at point B, at an inflation rate of ?', which is too high for to sustain economic growth. If an anti-inflationary policy is enacted, the economy will be in short-run equilibrium at point ________ creating ________ gap.

A. A; an expansionary B. D; an expansionary C. D; a recessionary D. A; a recessionary

If the government imposes a maximum price in a market that is below the equilibrium price:

A. total surplus in the market increases. B. total surplus in the market decreases. C. total surplus in the market does not change. D. total surplus may increase or decrease, depending on whether costs are increasing or decreasing in production.