Cornell and Joe are equal partners in Jones Company. For the current year, Jones reports the following items of income and expense:

Sales revenues$500,000

Long-term capital gains14,000

Short-term capital losses(30,000)

Trade and business expenses(200,000)

Limited partnership loss(50,000)

Taxable income$234,000

?

In addition to his Jones earnings, Joe has other net taxable income of $45,000. Included in the $45,000 is $10,000 in income from a passive activity. Joe's income is:

A. $152,000.

B. $157,000.

C. $162,000.

D. $167,000.

E. $182,000.

Answer: E

You might also like to view...

When compared with traditional contract law, the Uniform Commercial Code (UCC):

A. is more likely to find that parties have a contract. B. gives more weight to technical requirements such as consideration. C. reflects a less flexible attitude. D. is less concerned with rewarding people's legitimate expectations.

Where in a business report would the writer spell out exactly what should happen next and provide a schedule with specific task assignments?

A) In the restatement of qualifications B) In the motivating action section of the close C) In the conclusions and recommendation sections of the body D) In the review of arguments in the close E) In the work plan section of the body

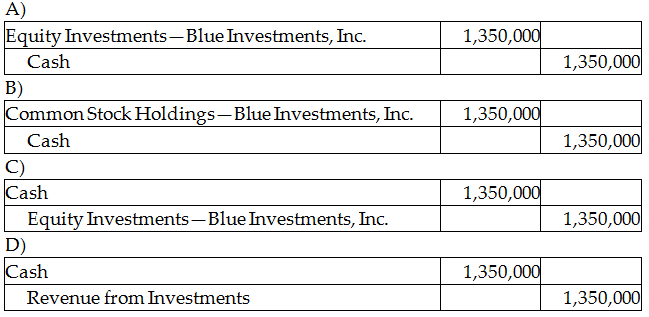

Premier Services, Inc. pays $1,350,000 to acquire 38% of voting stock of Blue Investments, Inc. on March 5, 2019. Which of the following is the correct journal entry for the transaction?

Assuming that Gtext elects to distribute service department costs to other service departments (starting with the factory cafeteria) as well as to the production departments, what would be the amount of factory cafeteria department costs that would be allocated to the general factory administration department, with the final answer rounded to the nearest dollar? (Note: Once a service department's

costs have been allocated, no subsequent service department costs are recirculated back to it.) a. $9,730 b. $0 c. $10,000 d. $37,895