Suppose a new employee is promised a pension payment of $8000 in the twenty-fourth year after joining the firm. The current pension contribution is $2000 a year. Assuming a six percent rate of return, this pension plan is said to be

A) fully funded.

B) partly funded.

C) unfunded.

D) fully vested.

A

You might also like to view...

If an increase in income leads to a decrease in the demand for salami, then salami is

A) a necessity. B) a neutral good. C) a normal good. D) an inferior good.

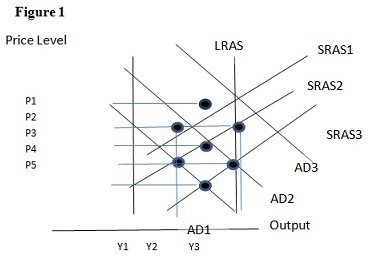

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD3 the result in the short run would be:

A. P1 and Y2. B. P2 and Y3. C. P3 and Y1. D. P2 and Y2.

Paper Pushers Inc. hires workers in a competitive labor market. Apart from labor, the company has no other variable inputs. The company's hourly output varies with the number of workers hired, as shown in the table. WorkersPages/hour0014027531054125514061507155 If the market price of each page is $5, the first worker's VMP is ________ per hour, and the third worker's VMP is ________ per hour.

A. $200; $150 B. $200; $525 C. $20; $525 D. $20; $15

The city in which a new casino is likely to have the smallest economic impact would be

A. Kansas City (where two already exist). B. St. Louis (where three already exist). C. Denton, TX (north of Dallas, where no casinos already exist). D. Las Vegas (where many already exist).