The federal funds rate is the interest rate that

A. the government pays on securities that mature in less than a year.

B. commercial banks charge their best customers to borrow money.

C. the Fed charges commercial banks to borrow reserves.

D. commercial banks charge each other for borrowing and lending reserves.

Answer: D

You might also like to view...

Hermione and Ron are at a sweet shop in London. Hermione looks at the prices of ice cream and chocolate bars and says to Ron: "I can tell you what your marginal rate of substitution between ice cream and chocolate bars is at your best affordable

point." "No, you can't," says Ron. "You don't know my preferences and how much money I have." "I don't need to know all this because I know the prices," Hermione replies. Is she right? Explain.

Which of the following events did not contribute to the high rate of savings and loan failures in the 1980s and 1990s?

a. The bankruptcy of the FDIC b. Deregulation of the banking industry that allowed investment houses to compete with banks and S&Ls for depositors c. The elimination of Regulation Q d. The entry of S&Ls into riskier loan markets e. Substantial fraud in lending activities

Which of the following best describes the impact of the Emissions Trading Scheme in the European Union between 2005 and the late 2010s?

A) Overall greenhouse gas emissions increased. B) Overall greenhouse gas emissions decreased. C) Overall greenhouse gas emissions were totally eliminated. D) Overall greenhouse gas emissions were constant.

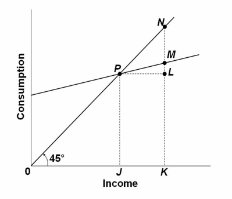

Refer to the consumption schedule above. The marginal propensity to consume is represented by:

A. GF/BE

B. EF/BE

C. GE/AB

D. DE/AB