What was the intent behind the intervention of the Fed and Treasury in financial markets during the Financial Crisis of 2007-2009?

What will be an ideal response?

The actions by the Fed and Treasury were meant to restore the flow of funds between savers and borrowers. Without an increase in the flow of funds to a more normal level, households would have a difficult time making certain purchases and businesses would have difficulty financing investments and inventories.

You might also like to view...

In 2012, about _____% of all Americans under the age of 65 did not have health insurance

a. 10% b. 12% c. 17% d. 20%

If one player defects in a repeated game, and his opponent is following a tit-for-tat strategy, we can predict the opponent will:

A. renegotiate. B. cooperate and try to get his opponent to follow. C. defect in the next round. D. collude.

Aggregate surplus:

A. is the sum of total willingness to pay and total avoidable costs of production. B. is minimized under perfect competition. C. is the sum of consumer and producer surpluses. D. is equal to zero in the long run.

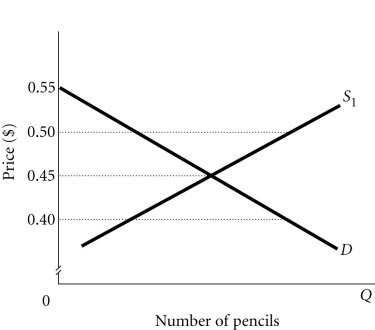

Refer to the information provided in Figure 4.3 below to answer the question(s) that follow. Figure 4.3Refer to Figure 4.3. Retailers will have an excess supply of pencils if the government will not allow retailers to charge less than ________ for a pencil.

Figure 4.3Refer to Figure 4.3. Retailers will have an excess supply of pencils if the government will not allow retailers to charge less than ________ for a pencil.

A. $0.50 B. $0.45 C. $0.40 D. the equilibrium price