When asset specificity is very low and there is no market uncertainty, it is best for a firm to:

A. buy in the open market.

B. vertically integrate.

C. use a long-term contract.

D. engage in a joint venture.

Answer: A

You might also like to view...

In cases where a life insurance policy owner is not the same person as the insured, insurance companies often require that such purchases be for those with an "insurable interest"

For life insurance policies, close family members and business partners will usually be found to meet this test. In this case the purchaser is demonstrating that they would suffer an economic loss if the insured were to die. What economic argument could be made for why insurance companies would make such a restriction when it seems there might be a market for life insurance to people who wish to insure others for whom there is not such "insurable interest"?

When quantity supplied increases at every possible price, we know that the supply curve has

a. shifted to the left. b. shifted to the right. c. not shifted; rather, we have moved along the supply curve to a new point on the same curve. d. not shifted; rather, the supply curve has become flatter.

An action that is the best choice under all conditions is known as the

A. prisoner's dilemma. B. dominant strategy. C. tit-for-tat strategy. D. profit-maximizing strategy.

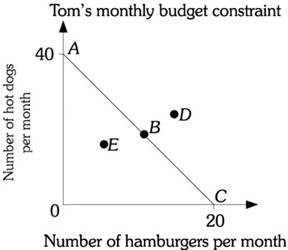

Refer to the information provided in Figure 6.1 below to answer the question(s) that follow. Figure 6.1Refer to Figure 6.1. Assume Tom is on budget constraint AC and the price of a hamburger is $5.00. Tom's monthly income is

Figure 6.1Refer to Figure 6.1. Assume Tom is on budget constraint AC and the price of a hamburger is $5.00. Tom's monthly income is

A. $4. B. $60. C. $80. D. $100.