"No central bank can be indifferent to its currency's value in the foreign exchange market." Discuss

What will be an ideal response?

— despite the "Monetary Policy Autonomy" theory of the original supporters of floating exchange rates

— exchange rate's role in inflation

— prices are sticky in the short run, so foreign developments can affect real interest rates and real exchange rates at home

— don't want their exchange rate to be too volatile as it affects the demand for their domestic products

— appreciation or depreciation can cause inflation that is difficult to counter

— banks intervene on a discretionary basis so it is still necessary for them to continue to hold foreign reserves

— "dirty floats" stabilize output and price level after shocks that affect exchange rates

— empirically: after 1973 countries have continued to intervene to affect exchange rates

You might also like to view...

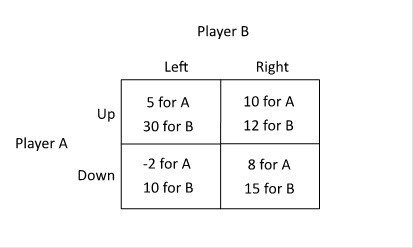

Refer to the figure below. Player A can infer that Player B will:

A. Player A cannot infer anything about what Player B will do given this matrix. B. choose Right. C. choose Left when A chooses Up and choose Right when A chooses Down. D. choose Left.

Economic theory would lead us to suspect that deep sea oil reserves would be accessed before those located in the Middle East or on the U.S. mainland

a. True b. False Indicate whether the statement is true or false

Which of the following is true of the production function? a. The production function of a normal good has a constant slope. b. The production function of a luxury good is a horizontal line. c. Generally, a production function has a negative slope

d. Generally, a production function has a variable slope.

On car insurance policies, Countrywide Insurance Company offers drivers an option: Policy 1 features a deductible of $1,000, and it requires a driver to pay an annual premium of $500 . Policy 2 features a deductible of $250, and it requires a driver to pay an annual premium of $1,000

a. In offering these two policies, Countrywide is engaging in illegal price discrimination. b. In offering these two policies, Countrywide is screening drivers. c. Policy 1 is more of a burden for safe drivers than it is for risky drivers. d. In offering these two policies, Countrywide is signaling their quality to drivers.