Suppose lower interest rates suddenly lead to an injection of $325 additional investment spending into the economy and the marginal propensity to consume is 0.80.Table 10.1Spending CyclesChange in this Cycle's Spending and IncomeCumulative Increase in Spending and IncomeFirst-cycle spending$325$325Second-cycle spending________________Third-cycle spending________________In Table 10.1, what will be the total increase in aggregate demand resulting from the initial $325 increase in investment expenditure after an infinite number of cycles?

A. $3,965.

B. $1,625.

C. $325.

D. $1,040.

Answer: B

You might also like to view...

If a meat packing plant has 30 employees and each employee has a 1 in 90 chance of getting injured on the job, then on average, one employee will get injured on the job every

A) 120 days. B) 1 year. C) 3 years. D) 9 years.

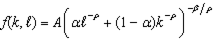

The production function

Answer the following statement true (T) or false (F)

If the demand faced by a firm is inelastic, selling one more unit of output will

a. increase revenues. b. decrease revenues. c. keep revenues constant. d. increase profits.

There are no idle resources, the multiplier is operative, and autonomous spending rises. It follows that

A) Real GDP will not increase. B) Real GDP will rise. C) prices will rise. D) a and c E) a, b, and c