The table below shows the demand and cost data facing "Velvet Touches," a monopolistically competitive producer of velvet throw pillows

Quantity Price Total Revenue Marginal Revenue Total Cost Marginal Cost

1 $30 $32

2 28 43

3 26 53

4 24 64

5 22 76

6 20 90

7 18 106

8 16 126

Use the data to answer the following questions.

a. Complete the Total Revenue (TR), Marginal Revenue (MR), and Marginal Cost (MC) columns above.

b. What are the profit-maximizing price and quantity for Velvet Touches?

c. Is the firm making a profit or a loss? How much is the profit or loss? Show your work.

d. Is this firm operating in the long run or in the short run? Explain your answer.

e. If the firm's profit or loss is typical of all firms in the market for throw pillows, what is likely to happen in the future? Will there be more firms or will some existing firms leave the industry? Explain your answer.

f. What will happen to the typical firm's profit or loss after all entry/exit adjustments?

a.

Quantity Price Total Revenue Marginal Revenue Total Cost Marginal Cost

1 $30 $30 $30 $32 $32

2 28 56 26 43 11

3 26 78 22 53 10

4 24 96 18 64 11

5 22 110 14 76 12

6 20 120 10 90 14

7 18 126 6 106 16

8 16 128 2 126 20

b. Q = 5; P = $22

c. Profit = $(110-76 )= $34

d. The firm is in the short run because it is making profits. In the long run all economic profits will be eliminated.

e. Short-run profits give entrepreneurs an incentive to enter the market and establish new firms. The demand curves for existing firms shift to the left and become more elastic. Entry continues until each firm makes zero economic profit (breaks even).

f. Each firm makes zero economic profit (breaks even).

You might also like to view...

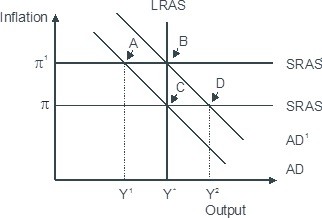

Based on the figure below. Starting from long-run equilibrium at point C, an increase in government spending that increases aggregate demand from AD to AD1 will lead to a short-run equilibrium at point ________ creating _____gap.

A. D; an expansionary B. B; no output C. B; expansionary D. A; a recessionary

Which of the following conditions could lead to an inefficient quantity of pretzels being produced?

A) the existence of many producers of pretzels B) the existence of many consumers of pretzels C) the existence of a single producer and seller of pretzels D) All of the above conditions could cause the actual quantity of pretzels to be an inefficient quantity.

Which of the following goods may have demand that is potentially affected by the bandwagon effect?

A) Satellite radio B) Cellular telephones C) High-definition (HD) televisions D) Electronic book readers E) all of the above

Sydney purchases a newly issued, two-year government bond with a principal amount of $10,000 and a coupon rate of 6 percent paid annually. One year before the bonds matures (and after receiving the coupon payment for the first year), Sydney sells the bond in the bond market. What price (rounded to the nearest dollar) will Sydney receive for his bond if newly issued one-year government bonds are paying a 5 percent coupon rate?

A. $10,000 B. $10,600 C. $10,095 D. $9,906