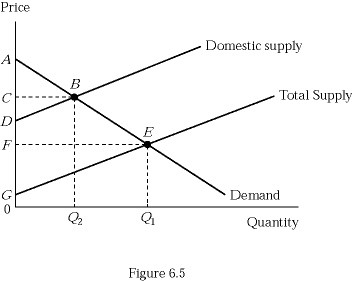

Figure 6.5 illustrates the market for sugar. If sugar imports were banned:

Figure 6.5 illustrates the market for sugar. If sugar imports were banned:

A. domestic producers gain at the expense of domestic consumers.

B. domestic consumers gain at the expense of domestic producers.

C. domestic consumers gain at the expense of foreign producers.

D. foreign producers gain at the expense of domestic consumers and producers.

Answer: A

You might also like to view...

Suppose the government imposes an 8 percent sales tax on clothing items and the tax is levied on sellers. Who pays for the tax in this situation? (Assume that the demand curve is downward sloping and that the supply curve is upward sloping.)

A) The sellers will pass on the entire sales tax to consumers and therefore the consumers bear the tax. B) The tax will be borne partly by consumers and partly by sellers. C) It is not possible to answer the question without information on price elasticities. D) The tax is borne entirely by the sellers.

Over the long term, the stock market has ______.

a. lost money across the board b. outperformed other investment categories c. underperformed money left in savings accounts d. maintained a steady value, without major losses or gains

A tie-in sale is a business practice where a business:

A. requires a customer of a product to purchase another product. B. requires another business to purchase its product. C. gives a customer a discount on future purchases of the same product. D. gives a customer a discount on future purchases of a different product.

The law passed by Congress in 1914 that was designed to sharpen or define further the vagueness of the Sherman Act is called

A. the Robinson-Patman Act. B. the Wheeler-Lea Act. C. the Federal Trade Commission Act. D. the Clayton Act.