Gosling, Inc., a calendar year, accrual basis corporation, reported $756,000 net income after tax on its financial statements prepared in accordance with GAAP. The corporation's financial records reveal the following information:Gosling earned $3,500 on an investment in tax-exempt municipal bonds.

Gosling received an advance payment of rent this year for $25,000. This amount was not included in book income.

Gosling's depreciation expense per books was $72,000, and its MACRS depreciation deduction was $105,000.

Gosling recorded $58,000 of business meals and $27,000 of entertainment expense for book purposes.

Gosling's federal income tax expense per books was $220,000.

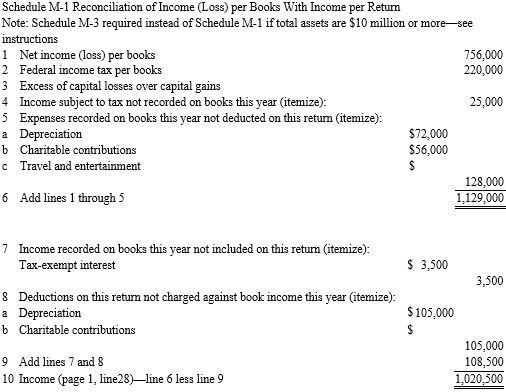

a. Compute Gosling's taxable income and regular tax liability.b. Prepare a Schedule M-1, page 5, Form 1120, reconciling Gosling's book and taxable income.

What will be an ideal response?

a. Taxable income: $1,020,500 = $756,000 ? $3,500 + $25,000 + $72,000 ? $105,000 + (50% × $58,000 + $27,000) + $220,000. Regular tax liability: $214,305.

b.

You might also like to view...

There are several ways that an existing relationship changes negotiation dynamics. Which one of the following is not one of those ways?

A. Distributive issues can be emotionally hot. B. Relationship preservation is the overarching negotiation goal. C. In many negotiations, the other person is the focal problem. D. All of these choices are correct.

A(n) ________ breach of a contract occurs when a party renders inferior performance of his or her contractual obligations

A) material B) minor C) anticipatory D) defensive

When is a legal acceptance by email effective?

A) when the email is sent B) when the email arrives C) when the offeror reads it D) offers cannot be validly accepted by email

Nashville, Tennessee, passes an ordinance to regulate waste disposal. The disposal of waste may also be regulated by

a. all other levels of government. b. no other levels of government. c. the federal government only . d. theTennessee state government only.