A combination of Fed purchases of government securities and an increase in reserve requirements would:

a. increase the money supply

b. decrease the money supply.

c. leave the money supply unchanged.

d. have an indeterminate effect on the money supply.

d

You might also like to view...

Suppose the nominal annual interest rate on a 2-year loan is 8% and lenders expect inflation to be 5% in each of the two years. The annual real rate of interest is

A. 3%. B. 6%. C. 8%. D. 2%.

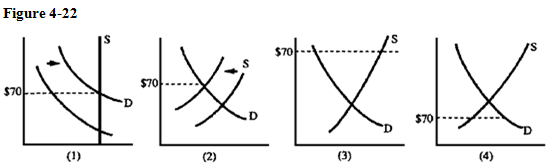

A. 1 B. 2 C. 3 D. 4

The above figure shows the AE curve and 45° line for an economy

a. If real GDP equals $10 trillion, how do firms' inventories compare to their planned inventories? b. If real GDP equals $20 trillion, how do firms' inventories compare to their planned inventories? c. What is the equilibrium level of expenditure? Why is this amount the equilibrium?

Suppose a perfectly competitive increasing-cost industry is in long-run equilibrium when market demand suddenly increases. What happens to the typical firm in the long run?

a. It experiences no change from the original equilibrium b. It experiences a higher average total cost and equilibrium price c. It experiences a lower average total cost and equilibrium price d. It experiences the same equilibrium price but a greater average total cost e. It experiences the same equilibrium price but a lower average total cost