If the government imposes a per-unit tax on sales of an industry's product, then we would expect

A) the supply curve in that industry would shift to the left.

B) the supply curve in that industry would shift to the right.

C) the demand curve for that industry would shift to the right.

D) the demand curve for that industry would shift to the left.

A

You might also like to view...

In a two-period model with production, a decrease in the world real interest rate

A) increases the current account surplus and increases real output. B) reduces the current account surplus and increases real output. C) increases the current account surplus and reduces real output. D) reduces the current account surplus and reduces real output.

The variation in the rate of return one can expect from ownership of stocks will generally be smaller if

a. all of the funds are invested in a specific sector of the economy such as the automobile industry. b. a diverse set of stocks is held over a lengthy period of time such as 30 or 40 years. c. all of the funds are invested in a single stock. d. the funds are invested for a relatively short period of time.

Constant dollars are dollars

A. issued by the Federal Reserve with values that fail to change even in the face of inflation or deflation. B. corrected for general price level changes. C. issued by the U.S. Treasury with values that fail to change even in the face of inflation or deflation. D. measured in terms of current-year prices.

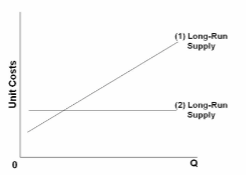

Refer to the diagram. Line (1) reflects the long-run supply curve for:

A. a constant-cost industry.

B. a decreasing-cost industry.

C. an increasing-cost industry.

D. a technologically progressive industry.