Explain why the top executives of Société Générale are more likely to be blamed than Jérôme Kerviel.

What will be an ideal response?

Kerviel had been playing the markets for over a year and several red flags were ignored by the bank managers. The supervisors accepted Kerviel's trades without much difficulty. The managers were ready to go along, as long as Kerviel was not making any money for himself, and as long as his activities were creating some benefit for the system. The managers had embraced a system of risk taking. It is their irresponsibility primarily that behooved Kerviel to behave the way he did.

You might also like to view...

The table above gives the U.S. CPI for six years. Calculate the inflation rates between 1997 to 1998, 1998 to 1999, 1999 to 2000, 2000 to 2001, and 2001 to 2002

What will be an ideal response?

Higher prices tend to reduce the quantity demanded

What will be an ideal response?

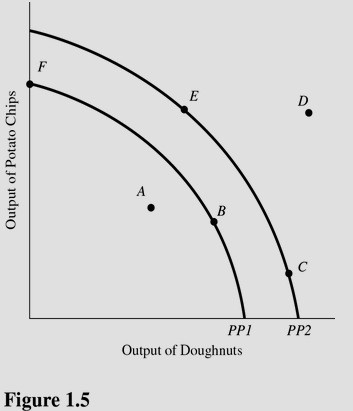

Using Figure 1.5, if an economy has the capacity to produce represented by PP2, then point E represents

Using Figure 1.5, if an economy has the capacity to produce represented by PP2, then point E represents

A. An efficient use of resources. B. A constant trade-off between potato chips and doughnuts. C. A combination of potato chips and doughnuts that is not attainable. D. None of the choices are correct.

When economists say a market has "barriers to entry," they refer to:

A. monopolists being prohibited from selling their products to certain customers. B. a policy that some countries establish to reduce imports from other countries. C. factors that prevent other firms from challenging a firm with market power. D. economic profits that are positive, but too high to encourage entry.