On a bank's T-account, which are part of the banks liabilities?

a. both deposits made by its customers and reserves

b. deposits made by its customers but not reserves

c. reserves but not deposits made by its customers

d. neither deposits made by its customers nor reserves

b

You might also like to view...

Given the information in the above table, the relationship between x and y is

A) positive, and the curve becomes flatter as x increases. B) positive, and the curve becomes steeper as x increases. C) positive and linear. D) negative and linear.

If the government were to increase taxes, it would be enacting:

A. contractionary fiscal policy. B. expansionary fiscal policy. C. contractionary monetary policy D. expansionary budgetary policy.

Assume a marginal propensity to consume of three-fourths. If private planned investment decreases by $10 billion and government spending increases by $13 billion, the national income will increase by

a. $4 billion. b. $12 billion. c. $3 billion. d. $2.25 billion.

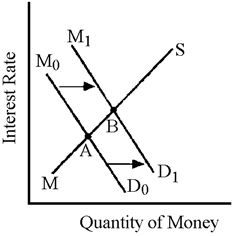

Figure 16-3

Figure 16-3 shows the impact of deficit spending and the corresponding economic expansion on the demand curve for money. If the Federal Reserve does not want interest rates to rise, it will

a.

shift the money supply curve to the right by monetizing the deficit.

b.

shift the money supply curve to the left by open market sales of government securities.

c.

maintain the current targets for both M1 and M2 money stocks.

d.

engage in contractionary monetary policy, such as increases in the discount rate.