A competitive firm has been selling its output for $20 per unit and has been maximizing its profit, which is positive. Then, the price rises to $25, and the firm makes whatever adjustments are necessary to maximize its profit at the now-higher price. Once the firm has adjusted, its

a. quantity of output is higher than it was previously.

b. average total cost is higher than it was previously.

c. marginal revenue is higher than it was previously.

d. All of the above are correct.

d

You might also like to view...

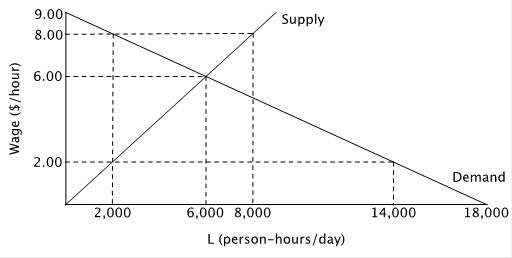

Consider the labor market below. Suppose the government passes a minimum wage requiring employers to pay at least $8.00 per hour.  After the imposition of the minimum wage, employment will equal ________ person-hours per day.

After the imposition of the minimum wage, employment will equal ________ person-hours per day.

A. 4,000 B. 8,000 C. 6,000 D. 2,000

A tariff is imposed on a good. The tariff will ________ the domestic quantity supplied, ________ the domestic quantity demanded, and ________ price in the home country

A) increase; decrease; increase B) increase; remain unchanged; remain unchanged C) increase; increase; increase D) increase; decrease; decrease

The potential for maximizing total industry profits is greater in oligopolies than in perfect competition because

A. There are fewer firms and each is dependent on the actions of rivals. B. Firms in an oligopoly are more profitable. C. Perfectly competitive firms can easily cooperate to restrict supply. D. There are independent firms in an oligopoly.

Which does NOT cause an industry that might otherwise be competitive to tend toward oligopoly?

A) economies of scale B) barriers to entry C) mergers D) strategic independence