Since 1972, the world price of oil has been largely determined by OPEC, which controls about 75 percent of the world's proven oil reserves. Since 1972 the price of oil has

A) fluctuated. OPEC's situation is an example of a prisoner's dilemma.

B) risen slowly, but steadily. Members of OPEC fear that if they raise the price of oil too quickly this will lead oil-buying nations to accuse OPEC of price gouging, which is illegal under international law.

C) been tied by OPEC to the rate of inflation in the United States. If, for example, the rate of inflation is 5 percent in one year, OPEC will raise the price of oil by 5 percent the next year.

D) steadily fallen through the 1970s, then risen continually in the years since then. OPEC's actions are an example of implicit collusion.

A

You might also like to view...

Answer the next question using the following budget information for a hypothetical economy. All data are in billions of dollars. Also assume that all budget surpluses are used to pay down the public debt. Government SpendingTax RevenuesGDPYear 1$800$825$4,000Year 28508504,200Year 39008754,350Year 49509004,500Year 51,0009254,600Assume that year 1 is the first year for this economy and year 3 is the current year. What is the public debt in this economy at year 3?

A. $75 billion B. $50 billion C. $25 billion D. $0 billion

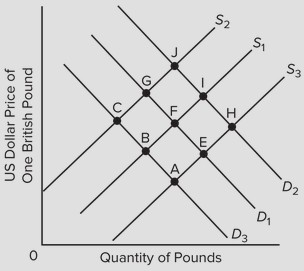

Use the following graph, which shows the supply and demand for British pounds, to answer the next question. D1 and S1 represent the initial demand and supply curves. If the supply of British pounds in the foreign exchange market shifts to S3, and the British government wants to fix the exchange rate at its initial level, then it should ________.

D1 and S1 represent the initial demand and supply curves. If the supply of British pounds in the foreign exchange market shifts to S3, and the British government wants to fix the exchange rate at its initial level, then it should ________.

A. buy U.S. dollars to add to its reserves B. sell U.S. dollars out of its reserves C. buy British bonds in the open market D. sell British pounds in the foreign exchange market

Suppose Maria can make 12 pizzas or 4 lasagnas every Saturday afternoon, while Gina can make 10 pizzas or 2 lasagnas every Saturday afternoon. Which statement is true?

A) Maria is the most efficient producer of both pizza and lasagna. B) Gina is the least efficient producer of both pizza and lasagna. C) It costs Maria 3 pizzas to produce 1 lasagna. D) It costs Gina 5 lasagnas to produce 1 pizza. E) All of the above are true.

When a profit-maximizing firm in a competitive market experiences rising prices, it will respond with an increase in production

a. True b. False Indicate whether the statement is true or false