What is one problem with using a Clarke tax to finance government provision of a public good?

a. People tend to overstate their preferences for the public good when a Clarke tax is imposed.

b. The government may decide against providing the public good, even when it would be efficient to do so.

c. The Clarke tax is not a fair tax, because everyone pays the same amount regardless of income.

d. The revenues collected from the Clarke tax may not cover the cost of the public good.

d. The revenues collected from the Clarke tax may not cover the cost of the public good.

You might also like to view...

Something that changes incentives so as to make otherwise empty threats or promises credible is called a:

A. dominant strategy. B. commitment device. C. strategic device. D. Nash equilibrium.

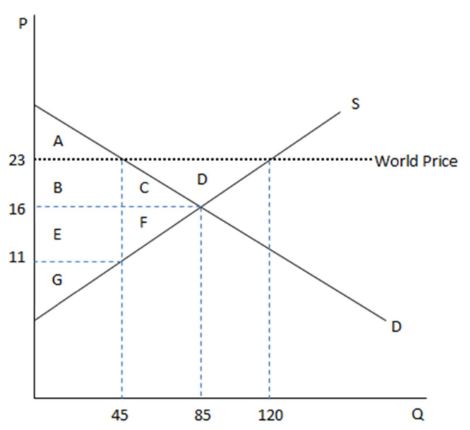

According to the graph shown, if this economy were to open to trade, domestic producers would increase:

This graph demonstrates the domestic demand and supply for a good, as well as the world price for that good.

A. enjoy a net gain to surplus of BC.

B. suffer a net loss to surplus of BCD.

C. suffer a transfer of surplus to producers of BC.

D. experience deadweight loss of FG.

If the government of a country decides to cut the tax rates, there will be a(n): a. upward movement along the short-run Phillips curve. b. downward movement along the short-run Phillips curve. c. rightward shift of the short-run Phillips curve

d. leftward shift of the short-run Phillips curve.

The cost of a bachelor's degree in philosophy equals the tuition plus the cost of room and board.

Answer the following statement true (T) or false (F)