Which of the following statements is correct regarding the imposition of a tax on gasoline?

a. The incidence of the tax always falls on the buyer

b. The incidence of the tax depends upon the price elasticities of demand and supply.

c. The incidence of the tax always falls on the sellers.

d. The oil company will ultimately pay.

b

You might also like to view...

Refer to Table 5.1. Hector has a comparative advantage in the production of

A) bracelets. B) tiaras. C) both products. D) neither product.

Last year in Candamica, consumption expenditure was $20 billion, interest, rent, and profit were $2.5 billion, government expenditure on goods and services was $7 billion,

net exports of goods and services was $5 billion, and investment was $2 billion. Hence total expenditure was A) $24.5 billion. B) $34.5 billion. C) $36.5 billion. D) $34 billion. E) undetermined without information about imports.

Common property

a. is owned by specific people. b. is inexhaustible. c. refers strictly to land resource. d. refers to goods "owned" by society at large and freely usable by anyone.

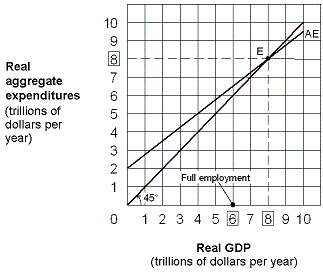

Exhibit 9-5 Keynesian aggregate expenditures model where the MPC is 0.75

?

A. in a recessionary gap. B. in an inflationary gap. C. fully employed. D. substantially underemployed.