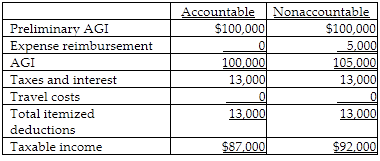

Pat is a sales representative for a publishing company. He travels extensively as part of his job. During the current year he spends $10,000 on business travel. The company reimburses him $5,000. Before consideration of the travel costs and the reimbursement, Pat earns AGI of $100,000, and he has itemized deductions of $13,000 due to mortgage interest and taxes. Pat is single, with no dependents.

What is Pat's taxable income

a. assuming the employer maintains an accountable plan?

b. assuming the employer does not maintain an accountable plan?

You might also like to view...

Which of the following is an example of an online privacy violation?

A. your e-mail being read by a hacker B. your online purchasing history being sold to other merchants without your consent C. your computer being used as part of a botnet D. your e-mail being altered by a hacker

Uniq Works purchased raw materials amounting to $126,000 on account and $16,000 for cash. The materials will be used to manufacture upholstery for furniture manufacturers on a contract basis. Which of the following journal entries correctly records this transaction?

Which of the following is NOT an area of responsibility for a logistics manager?

A) information B) storage location C) marketing D) inventory E) production

McDonald Industries is considering the purchase of a $180,000 machine that is expected to result in a decrease of $20,000 per year in cash expenses. This machine, which has no residual value, has an estimated useful life of 15 years and will be depreciated on a straight-line basis. For this machine, the accounting rate of return would be

a. 4.4 percent b. 8.9 percent c. 11.1 percent d. 22.2 percent