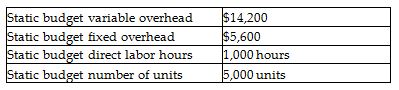

The following information relates to Tablerock Manufacturing's overhead costs for the month:

Tablerock allocates variable manufacturing overhead to production based on standard direct labor hours.

Tablerock reported the following actual results for last month: actual variable overhead, $14,500; actual fixed overhead, $5,400; actual production of 4,700 units at 0.22 direct labor hours per unit. The standard direct labor time is 0.20 direct labor hours per unit.

Compute the variable overhead cost variance. (Round intermediate calculations to two decimal places and the answer to the nearest dollar.)

Variable overhead cost variance: (AC - SC) × AQ = ($14.02 - $14.20) × 1,034 = 186 F

* Standard VOH allocation rate: Budgeted VOH / Budgeted allocation base

$14,200 / 1,000 = $14.20 per DL Hr

** 4,700 units produced × 0.22 actual direct labor hours per unit =1,034 DLHr

***AC = $14,500/(4,700 × 0.22) = $14.02

You might also like to view...

A trade policy designed to alleviate some domestic economic problem by exporting it to foreign countries is known as a (an)

a. international dumping policy. b. trade adjustment assistance policy. c. most-favored-nation policy. d. beggar-thy-neighbor policy.

Which of the following is true of an economic strike?

A) It is a nonviolent work stoppage for the purpose of protesting an employer's commission of an unfair labor practice. B) It is a protected activity and strikers are entitled to return to their jobs once the strike is over. C) Employers are not allowed to fill economic strikers' jobs while the strike is taking place. D) Since employers cannot permanently replace economic strikers, this strike is considered a potent weapon.

As environmental uncertainty increases, managers must develop techniques and methods for collecting, sorting through, and interpreting information about the environment. Discuss four of these methods, explaining when and why each would be used.

What will be an ideal response?

The Treaty of Rome regulates:

a. concerted anticompetitive conduct. b. mergers. c. abuse of market dominant position. d. Both a and c