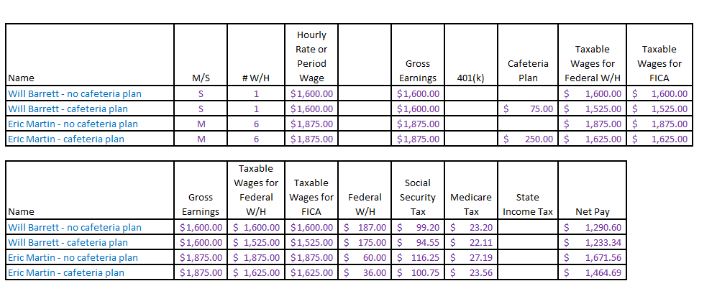

Compute the net pay for Will Barrett and Eric Martin. Assuming that they are paid biweekly, subject to federal income tax (using the wage-bracket method in Appendix C) and FICA taxes, and have no other deductions from their pay. Will’s deduction if he chooses to participate in the qualified cafeteria plan is $75; Eric’s is $250. There is no deduction if they do not participate in the

qualified cafeteria plan.

What will be an ideal response?

You might also like to view...

Probably the last account to be listed on a post-closing trial balance would be

A) Income Summary. B) Wages Payable. C) Retained Earnings. D) Wages Expense.

Water Pollution. Taylor Bay Protective Association is a nonprofit corporation established for the purpose of restoring and improving the water quality of Taylor Bay. Local water districts began operating a flood-control project in the area. As part of

the project, a pumping station was developed. Testimony at trial revealed that the pumps were operated contrary to the in-structions provided in the operation and maintenance manual. The pumps acted as vacuums, sucking up silt and depositing the silt in Taylor Bay. Thus, the project resulted in sedimentation and turbidity (a condition of having dense, stirred-up particles) problems in the downstream wa-tercourse of Taylor Bay. The association sued the local water districts, alleging that the pump-ing operations created a nuisance. Do the pumping operations qualify as a common law nui-sance? Who should be responsible for the cleanup costs? Discuss both questions fully.

In simple linear regression, most often we perform a two-tail test of the population slope ?1 to determine whether there is sufficient evidence to infer that a linear relationship exists. The null hypothesis is stated as:

a. H0: ?1 = 0 b. H0: ?1 = b1 c. H0: ?1 ? 0 d. None of these choices.

The taxpayer need not pay the disputed tax in advance when the suit is initiated in

A) U.S. Court of Federal Claims. B) U.S. Tax Court. C) U.S. District Court. D) both A and B.