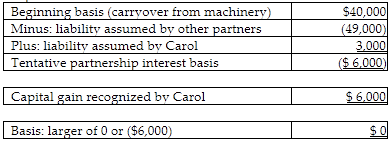

For a 30% interest in partnership capital, profits, and losses, Carol contributes a machine with a basis of $40,000 and an FMV of $80,000. The partnership assumes a $70,000 recourse liability on the machine. At the time of the contribution, the partnership had recourse liabilities of $10,000. Partners share the economic risk of loss from recourse liabilities in the same way they share partnership

losses. Following the contribution, Carol has

A) a capital loss due to the contribution of $6,000 and a zero basis in the partnership interest.

B) a capital gain due to the contribution of $6,000 and a zero basis in the partnership interest.

C) a $34,000 basis in the partnership interest and no gain or loss.

D) a $43,000 basis in the partnership interest and no gain or loss.

B) a capital gain due to the contribution of $6,000 and a zero basis in the partnership interest.

You might also like to view...

In performance management, ______ are considered the actions taken by an individual.

A. results B. behaviors C. motivations D. traits

Variable costs are costs that remain constant in total dollar amount as the level of activity changes

Indicate whether the statement is true or false

The method of determining the cost of a product or service based on the price that customers are willing to pay is called

A) relevant costing. B) differential costing. C) target costing. D) product costing. E) overall costing.

Margin trading will magnify losses on a percentage basis

Indicate whether the statement is true or false.