The government might increase its spending to end a recession because:

A. allowing the short-run aggregate supply to adjust since back to the long-run can take a long time.

B. the economy experiences lower prices at the long-run equilibrium.

C. the economy enjoys a higher level of output in the long run.

D. None of these justify why the government might change its spending to end a recession.

A. allowing the short-run aggregate supply to adjust since back to the long-run can take a long time.

You might also like to view...

KFC raises the price of its grilled chicken. The price elasticity of demand for KFC grilled chicken is 0.8. What happens to the KFC's total revenue?

A) nothing B) It increases. C) It decreases. D) It becomes negative. E) It might change, but more information is needed to determine if it increases, decreases, or does not change.

Suppose that a negative income tax was created that set a minimum income for a family of $5,000 per year and had a marginal tax rate of 33 percent. What is the break-even level of income? If a person earned $5,000 . what would the after-tax income level be? If the earnings were $10,000 . what would the after-tax income be?

Explain why most indifference curves are convex

What will be an ideal response?

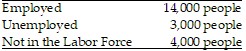

Refer to the information provided in Table 22.1 below to answer the question(s) that follow. Table 22.1 Refer to Table 22.1. The unemployment rate is

Refer to Table 22.1. The unemployment rate is

A. 14.3%. B. 16.7%. C. 17.6%. D. 25.0%.