Answer the following statements true (T) or false (F)

1. Economics is the social science concerned with the best use of scarce resources to achieve maximum satisfaction of economic wants.

2. Marginal analysis is the valuation of insignificant or small benefits from doing things.

3. Rational behavior implies that different people faced with similar choices will make the same decisions.

4. Economic analysis is primarily concerned with marginal changes from the status quo, as a result of a certain action or decision.

1. Answer: True

2. Answer: False

3. Answer: False

4. Answer: True

You might also like to view...

Which of the following macroeconomic variables is countercyclical?

A) Real interest rates B) Unemployment C) Money growth D) Consumption

Assume that the central bank increases the reserve requirement. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the quantity of real loanable funds per time period and current international transactions in the context of the Three-Sector-Model?

a. The quantity of real loanable funds per time period falls, and current international transactions becomes more negative (or less positive). b. The quantity of real loanable funds per time period rises, and current international transactions becomes more positive (or less negative). c. The quantity of real loanable funds per time period rises, and current international transactions remain the same. d. There is not enough information to determine what happens to these two macroeconomic variables. e. The quantity of real loanable funds per time period and current international transactions remain the same.

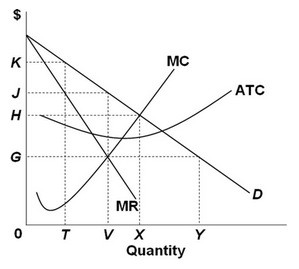

Refer to the above graph. The profit-maximizing monopolist shown sets its output at:

Refer to the above graph. The profit-maximizing monopolist shown sets its output at:

A. 0Y. B. 0X. C. 0T. D. 0V.

The real rate of interest will approximately be equal to

A) the nominal interest rate plus the expected rate of inflation. B) the stated rate of interest in a high-inflation economy. C) the nominal interest rate minus the expected rate of change in the price level. D) the stated rate minus the opportunity cost of capital.