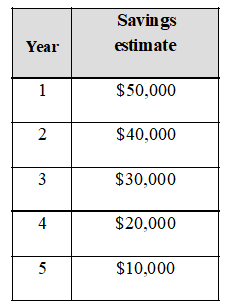

Zebra micro-devices, Inc. is considering an investment in new equipment that will cost $120,000 and is estimated to provide the following annual savings over its 5-year life:

a) Should the company acquire the new equipment if it can earn a return of 12% on its investments?

b) Should the company acquire the new equipment if it can earn a return of 9% on its investments?

c) Use the principal of value additivity to calculate the present value of the savings.

d) What is the implied annual rate of return is associated with the new equipment?

a) With a 12% required return, the company should not accept the investment as the value is less than the cost.

b) With a 9% required return, the company should accept the investment as the value is greater than the cost.

c) See calculations

d) The compound average annual rate of return (i.e., the IRR) is 10.39%. This indicates that at any required return of 10.39%, or less, the investment should be accepted.

You might also like to view...

Through the use of big data, cable television has the ability to deliver specific ads to each household instead of advertising to everyone watching a particular show.

Answer the following statement true (T) or false (F)

Given the many differences in majors available, living options, and image differences, universities would be classified as a heterogeneous shopping product for most people.

Answer the following statement true (T) or false (F)

Original mortgagee

A)?$0 B)?$2,000 C)?$4,000 D)?$6,000 E)?$8,000 F)?$92,000 Indicate whether the statement is true or false

According to the text, the Competitive Equality in Banking Act of 1987

A) turned the thrift industry around by providing the necessary funds to close the "zombie S&Ls." B) lowered the cost of bailing out the S&Ls by quickly closing "zombie S&Ls" before they could cause other thrifts to fail. C) failed to provide the funds necessary to close ailing S&Ls, and actually encouraged regulators to continue to pursue regulatory forbearance. D) did both A and B of the above.