If the actual federal funds rate is 9 percent and the Fed's target federal funds rate is 8 percent, the Fed is most likely to adopt which of the following policies?

A. A sale of government bonds

B. A reduction in the reserve requirement

C. A more contractionary monetary policy

D. An increase in the discount rate

Answer: B

You might also like to view...

If the economy enters an expansion

A) cyclical unemployment increases. B) structural unemployment increases. C) cyclical unemployment decreases. D) structural unemployment decreases.

Average labor productivity is computed as the

A) ratio of industrial production to the employment rate. B) ratio of real output in manufacturing to the level of real GDP. C) ratio of real GDP to the unemployment rate. D) ratio of real GDP to the level of employment.

A stock is:

A. a financial asset that represents partial ownership of a company. B. a payment made periodically to all shareholders of a company. C. an agreement in which a lender gives money to a borrower in exchange for a promise to repay the amount loaned plus an agreed-upon amount of interest. D. a promise by the bond issuer to repay the loan, at a specified maturity date, and to pay periodic interest at a specific percentage rate.

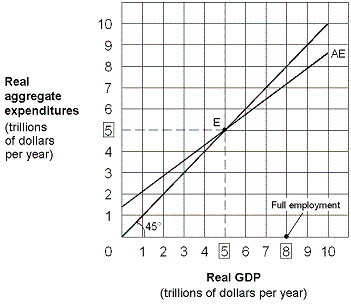

Exhibit 9-6 Keynesian aggregate expenditure model when the MPC is 2/3

?

A. 1 2/3. B. 2 1/2. C. 3. D. 5.