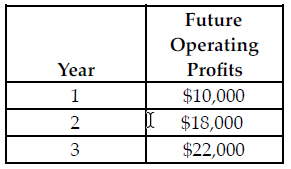

Refer to the table below. If the discount rate is 5 percent and the cost of the investment is $42,000, what is the net present value of the investment?

The above table shows the future operating profits from an investment. The future operating profits are earned at the end of each of the respective years.

A) $44,854.77

B) $2,854.77

C) $3,599.22

D) $42,464.22

B) $2,854.77

You might also like to view...

Two competing firms in a duopoly must decide whether or not to offer consumers a coupon for their good. The payoff matrix above represents the daily profit available to the firms under the different coupon strategies

a. What strategies and payoffs are represented by quadrant A? b. What strategy will Firm 1 pursue if it believes that Firm 2 is offering a coupon? c. What quadrant represents the equilibrium that will result if the firms act independently (compete)? d. What quadrant represents the equilibrium that will result if the firms successfully collude?

Saving by households

A) decreases when the real interest rate rises. B) increases when the real interest rate rises. C) increases when the real interest rate falls. D) is unaffected by the real interest rate.

When positive externalities are present, it means that:

A. individuals don't take into account all the benefits associated with their market choice. B. society bears part of the cost borne of private transactions. C. individuals consume more than the social optimum. D. All of these statements are true.

In the long run, what determines the level of output

a. SRAS b. AD c. LAS d. Trump