Jazz Corporation owns 10 percent of the Williams Corp. stock. Williams distributed a $10,000 dividend to Jazz Corporation. Jazz Corp.'s taxable income (loss) before the dividend was ($2,000). What is the amount of Jazz's dividends received deduction on the dividend it received from Williams Corp.?

A. $6,500.

B. $5,000.

C. $4,000.

D. $0.

E. None of the choices are correct.

Answer: C

You might also like to view...

In 2010, dozens of Bangladeshis were killed in two separate fires in factories that made clothing for western clients such as JCPenney and Gap

In November 2012, 112 garment workers were killed when a fire broke out at Tazreen Fashions, a clothing manufacturer in Dhaka, Bangladesh. What are the implications of these tragic incidences on the export by a country dependent on exports?

Comprehensive income is

a. considered an appropriation of retained earnings when reported in the stockholders' equity section of the balance sheet. b. the result of all events and transactions that affect income during the accounting period that are reported on the income statement. c. reporting all items that are not under management's control on the statement of retained earnings. d. an all-inclusive approach to income that includes transactions that affect stockholders' equity with the exception of those transactions that affect owners.

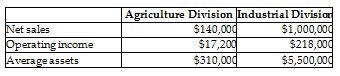

Evergreen Corporation has two major divisions: Agricultural Products and Industrial Products. It provides the following information for the year.

Calculate the profit margin ratio for the Industrial Division of the company. (Round your answer to two decimal places.)

A) 3.96%

B) 5.55%

C) 21.80%

D) 12.29%

For an effective interview, an expert should most likely be ________

A) defensive and objective B) confident and rigid C) informative and entertaining D) prepared and highly technical E) aloof and simplistic