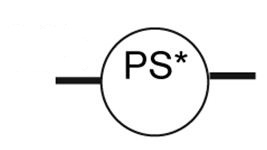

A rate of return analysis was initiated for the infinite-life alternatives shown below.

(a) Fill in the 10 blanks in the incremental rate of return (?i*) columns.

(b) How much revenue is associated with each alternative?

(c) Which alternative should be selected if they are mutually exclusive and MARR is 16% per year?

(d) Which alternative should be selected if they are mutually exclusive and MARR is 11% per year?

(e) Select the two best alternatives at MARR = 19% per year.

FIGURE 1.png)

(a) Find ROR for each increment of investment using the general relation

AW1 + AWII = AW2

where II = incremental investment

E vs F: 20,000(0.20) + 10,000(?i*) = 30,000(0.35)

?i* = 65%

E vs G: 20,000(0.20) + 30,000(?i*) = 50,000(0.25)

?i* = 28.3%

E vs H: 20,000(0.20) + 60,000(?i*) = 80,000(0.20) ?i* = 20%

F vs G: 30,000(0.35) + 20,000(?i*) = 50,000(0.25)

?i* = 10%

F vs H: 30,000(0.35) + 50,000(?i*) = 80,000(0.20)

?i* = 11%

G vs H: 50,000(0.25) + 30,000(?i*) = 80,000(0.20)

?i* = 11.7%

(b) Revenue = A = Pi

E: A = 20,000(0.20) = $4000

F: A = 30,000(0.35) = $10,500

G: A = 50,000(0.25) = $12,500

H: A = 80,000(0.20) = $16,000

(c) Conduct incremental analysis using results from part (a) with MARR = 16%

E vs DN: i* = 20% > MARR eliminate DN

E vs F: ?i* = 65% > MARR eliminate E

F vs G: ?i* = 10% < MARR eliminate G

F vs H: ?i* = 11% < MARR eliminate H

Therefore, select Alternative F

(d) Conduct incremental analysis using results from part (a) with MARR = 11%

E vs DN: i* = 20% > MARR, eliminate DN

E vs F: ?i* = 65% > MARR, eliminate E

F vs G: ?i* = 10% < MARR, eliminate G

F vs H: ?i* = 11% = MARR, eliminate F

Select alternative H

(e) Conduct incremental analysis using results from part (a) with MARR = 19%

E vs DN: i* = 20% > MARR, eliminate DN

E vs F: ?i* = 65% > MARR, eliminate E

F vs G: ?i* = 10% < MARR, eliminate G

F vs H: ?i* = 11% < MARR, eliminate H

Select F as first alternative; compare remaining alternatives incrementally.

E vs DN: i* = 20% > MARR, eliminate DN

E vs G: ?i* = 28.3% > MARR, eliminate E

G vs H: ?i* = 11.7% < MARR, eliminate H

Therefore, select alternatives F and G

You might also like to view...

IDENTIFY TEST PROCESS SYMBOLS AND DIAGRAMS

Foals are generally weaned between ____________________ and ____________________ months old

Fill in the blank(s) with correct word

Technician A says that the brake pedal height should be checked as part of a brake system inspection. Technician B says the pedal free play and pedal reserve should be checked. Which technician is correct?

A) Technician A only B) Technician B only C) Both Technicians A and B D) Neither Technician A nor B

Annual Fuel Utilization Efficiency, AFUE, is

A) The efficiency of the furnace for an entire heating season B) The cost of operating the furnace for an entire heating season C) Calculated by operating the furnace for one hour at the manufacturer's design condition D) Calculated by comparing a customer's gas bill to the calculated heat loss of their house