Suppose that you are given a cost function c(w,r,x)=2w1/2r1/2x3/2 where w is the wage rate for labor, r is the rental rate of capital and x is the output level.

a. Does the production process that gives rise to this cost function have increasing, decreasing or constant returns to scale?

b. Derive the marginal cost function.

c. Calculate the supply function for the firm - i.e. the function that tells us for every combination of input and output prices, how much the firm will optimally produce. How does output by the firm change as input and output prices change?

d. If the cost function had been c(w,r,x)=2w1/2r1/2x1/2 instead, how would your answer to (c) change? How can that make any sense?

What will be an ideal response?

and the derivative of this with respect to output is positive -- i.e. the MC curve is upward sloping. This implies decreasing returns to scale.

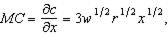

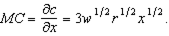

and the derivative of this with respect to output is positive -- i.e. the MC curve is upward sloping. This implies decreasing returns to scale.b. We derived it above as

(Part (a) could be answered without making explicit reference to the MC function.)

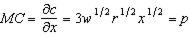

(Part (a) could be answered without making explicit reference to the MC function.)c. The supply function can be derived by setting MC equal to price and solving for output. (Recall the supply curve is the part of the MC curve that lies above AC -- and since we know this production process to have decreasing returns to scale throughout, the MC lies above AC everywhere.) Solving

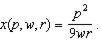

gives the supply function

d. In that case, the production process has increasing returns to scale (with downward-sloping MC). As a result, the firm's profit maximization problem does not have an interior solution -- the firm would produce an infinite amount. Of course this does not make sense -- because it does not make sense to assume price-taking firms can have production technologies that have increasing returns to scale throughout.

You might also like to view...

A person's wealth is the same as his income

Indicate whether the statement is true or false

U.S. government regulation of social and economic activity

A) only began after World War II. B) costs less now than it did in the 1980s. C) has increased steadily since 1970. D) is confined to antitrust law.

Which is not one of the four basic questions used by economists to break down problems?

A. What do others think? B. What are the trade-offs? C. How will others respond? D. Why isn't everyone already doing it?

Good A has a price elasticity of demand of .27, while good B has a price elasticity of demand of 2.9 . To raise the most tax revenue, the government should:

a. place a unit tax on good A. b. place a unit tax on good B. c. raise the price elasticity of demand for good A. d. subsidize the production of good B. e. cut its spending for various social programs.