Which of the following factors can contribute to a further reduction in the money supply in addition to a massive withdrawal of cash from banks?

A. Bank purchases of Treasury bonds from the Fed

B. Bank sales of government bonds to meet liquidity demands

C. Banks expand the approval and granting of loans

D. A decrease in the required reserve ratio

A. Bank purchases of Treasury bonds from the Fed

You might also like to view...

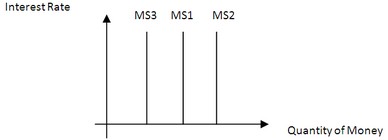

Use the following diagram to answer the next question. Which of the following would cause a move from MS1 to MS2?

Which of the following would cause a move from MS1 to MS2?

A. The banking system decides to hold less excess reserves and make more loans. B. The federal funds rate increases. C. The discount rate is increased by the regional Federal Reserve banks. D. The Federal Open Market Committee decides to sell bonds.

Refer to Figure 7-1. Suppose the government allows imports of leather footwear into the United States. What will be the domestic quantity supplied?

A) Q0 B) Q1 C) Q2 D) Q2 - Q0

If nominal GDP increased from $4,500 billion in 2010 to $5,000 billion in 2011 and the GDP deflator increased from 100 to 105 over the same time period, what would the 2011 real GDP equal expressed in terms of 2010 dollars?

a. $4,285 billion b. $4,500 billion c. $4,725 billion d. $4,762 billion

The quantity theory of money assumes that the velocity of money:

a. will rise if the money supply rises, but it will not change if the money supply falls. b. will fall if the money supply rises, and it will rise if the money supply falls. c. is constant. d. will rise if the money supply rises and fall if the money supply falls.