Figure 10.7 A Reduction in the Proportional Tax Rate

What will be an ideal response?

In the case of a proportional tax, a

tax cut reduces the tax rate t, which

increases the slope of the AD curve

and raises equilibrium income from

Y0 to Y1.

You might also like to view...

Which statement is true?

A. Our lower rate of productivity growth has been affected by our low rate of savings. B. Our lower rate of productivity growth has been caused almost entirely by our high rate of savings. C. Our high rate of productivity growth has been caused almost entirely by our high rate of savings. D. Our high rate of productivity growth has been caused almost entirely by our low rate of savings.

If the reserve ratio is 20 percent and reserves in the commercial banking system increase by $20,000, the maximum possible expansion of demand deposits is

A. $500,000. B. $40,000. C. $4,000. D. $100,000.

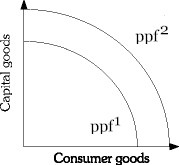

Refer to the information provided in Figure 2.6 below to answer the question(s) that follow. Figure 2.6Refer to Figure 2.6. If the economy is at ppf1, a change in consumer preferences would be shown by a

Figure 2.6Refer to Figure 2.6. If the economy is at ppf1, a change in consumer preferences would be shown by a

A. shift from ppf1 to ppf2. B. movement along ppf1. C. shift from ppf2 to ppf1. D. movement along ppf2.

If the market price for a good produced by a price taking firm is $8, the firm's total revenue is

A. downward sloping. B. a flat line at P=$8. C. parabolic. D. an upward sloping line beginning at the origin and having a slope of 8.