Some economists argue that corporate income taxes are typically not paid by firms, but by

A) stockholders, employees, and consumers.

B) the government.

C) bond holders.

D) the board of directors of the firm.

A

You might also like to view...

If a firm with two large plants installs a large, custom built packing machine in each of its plants, the custom packing machine is an example of ________.

A) managerial diseconomies B) specialized capital C) a compensating wage differential D) geographic variation

how do high tariffs and other restraints on international trade affect a nation's prosperity

What will be an ideal response?

The income elasticity of demand for raw agricultural products is ________ than the income elasticity of demand for non-food products

Fill in the blank(s) with correct word

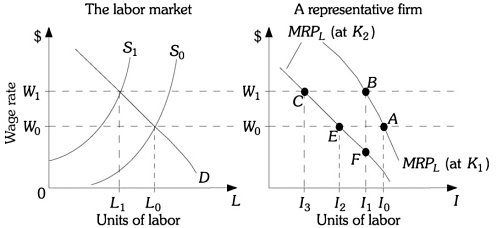

Refer to the information provided in Figure 10.3 below to answer the question(s) that follow.  Figure 10.3 Refer to Figure 10.3. The market wage is initially W0 and the firm is initially at Point A. Labor supply decreases from S0 to S1. If the firm does not change the amount of capital it employs, the firm will move to Point ________ to maximize profits.

Figure 10.3 Refer to Figure 10.3. The market wage is initially W0 and the firm is initially at Point A. Labor supply decreases from S0 to S1. If the firm does not change the amount of capital it employs, the firm will move to Point ________ to maximize profits.

A. B B. C C. E D. F