Why is the demand curve the same as the marginal benefit curve?

What will be an ideal response?

The demand curve for a good tells us for any quantity of the good, the dollar's worth of other goods and services that we are willing to forgo in order to get one more unit of the good in question. The marginal benefit of a good is the additional benefit from each unit of a good consumed. The additional benefit is measured by the amount of other goods and services we are willing to forgo to get one more unit of the good in question. Hence the demand curve is the same as the marginal benefit curve because the demand curve shows precisely what the marginal benefit curve measures.

You might also like to view...

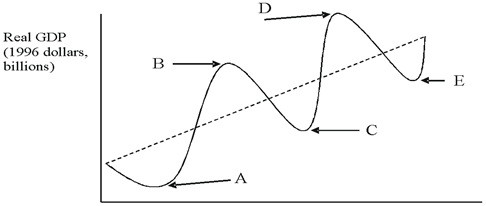

Refer to the figure below.  In the figure, a business cycle trough is shown by which point(s)?

In the figure, a business cycle trough is shown by which point(s)?

A. D only B. B and D C. A and C and E D. A only

The above figure shows the market for pizza. The market is in equilibrium when the cheese used to produce pizza falls in price. What point represents the most likely new price and quantity?

A) A B) B C) C D) D E) E

Assume that the central bank increases the reserve requirement. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the real risk-free interest rate and net nonreserve-related international borrowing/lending in the context of the Three-Sector-Model?

a. The real risk-free interest rate rises, and net nonreserve-related international borrowing/lending becomes more positive (or less negative). b. There is not enough information to determine what happens to these two macroeconomic variables. c. The real risk-free interest rate and net nonreserve-related international borrowing/lending remain the same. d. The real risk-free interest rate rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). e. The real risk-free interest rate falls, and net nonreserve-related international borrowing/lending becomes more negative (or less positive).

In monopolistic competition, a firm’s profit-maximizing price is found by determining how much ______.

a. will be demanded at the equilibrium quantity b. marginal cost is below or above average total cost c. will be demanded at the highest possible price d. marginal revenue is below or above average total cost