If no fiscal policy changes are implemented to fight inflation, suppose the aggregate demand curve will exceed the current aggregate demand curve by $900 billion at any level of prices. Assuming the marginal propensity to consume is 0.90, this increase in aggregate demand could be prevented by:

A. increasing government spending by $500 billion.

B. increasing government spending by $140 billion.

C. decreasing taxes by $40 billion.

D. increasing taxes by $100 billion.

Answer: D

You might also like to view...

The Bland-Allison Act of 1878 and the subsequent Sherman Silver Purchase Act of 1890:

a. led to an extended period of inflation in the U.S. b. were both followed by increases in the market price for silver. c. had no significant impact on silver prices or the price level. d. decreased the Treasury's supply of silver.

Using an approximation to the UIP eqaution to determine the spot exchange rate, assume that the expected spot rate (after 1 year) for euros (in terms of dollars)= $1.50, the current interest rate on euro deposits is 2% and the current interest rate on dollar deposits is 6%. What current spot for euros would satisfy the equation?

a) $1.5*(1+2%)= $1.53 b) $1.5*(1-2%)= $1.47 c) $(1.5/(1+4%)= $1.442 d) $(1.5/(1-4%)= $1.563

A perfectly competitive firm's marginal cost curve above the minimum of the average variable cost curve is its:

A. short-run supply curve. B. average cost schedule. C. capacity output schedule. D. total revenue minus total cost schedule.

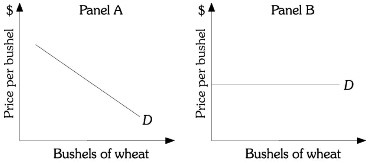

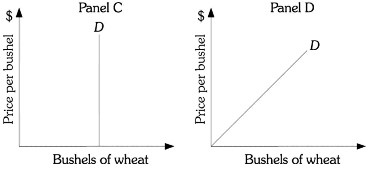

Refer to the information provided in Figure 8.10 below to answer the question(s) that follow.

Figure 8.10 Refer to Figure 8.10. Panel ________ represents the demand curve facing a perfectly competitive producer of wheat.

Figure 8.10 Refer to Figure 8.10. Panel ________ represents the demand curve facing a perfectly competitive producer of wheat.

A. A B. B C. C D. D