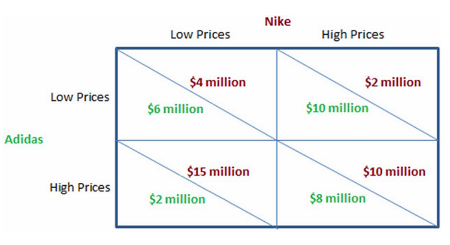

The figure shown portrays a game using a:

A. decision tree.

B. decision matrix.

C. flowchart.

D. graph.

B. decision matrix.

You might also like to view...

The figure above shows the U.S. production function. How would an increase in unemployment benefits be shown in the figure?

A) a movement from point C to point B B) a movement from point A to point B C) an upward shift or rotation of the production function D) a downward shift or rotation of the production function E) None of the above because the effects of an increase in unemployment benefits cannot be shown in the figure.

In the Keynesian model in the long run, a decrease in the money supply will cause

A) a decrease in output and an increase in the real interest rate. B) an increase in the real interest rate but no change in output. C) a decrease in the real interest rate and a decrease in output. D) no change in either the real interest rate or output.

Assume that the central bank increases the reserve requirement. If the nation has highly mobile international capital markets and a flexible exchange rate system, what happens to the real risk-free interest rate and net nonreserve-related international borrowing/lending in the context of the Three-Sector-Model?

a. The real risk-free interest rate rises, and net nonreserve-related international borrowing/lending becomes more positive (or less negative). b. There is not enough information to determine what happens to these two macroeconomic variables. c. The real risk-free interest rate and net nonreserve-related international borrowing/lending remain the same. d. The real risk-free interest rate rises, and net nonreserve-related international borrowing/lending becomes more negative (or less positive). e. The real risk-free interest rate falls, and net nonreserve-related international borrowing/lending becomes more negative (or less positive).

Which of the following is likely to lead to a decrease in the demand for tennis balls?

A. An increase in the price of tennis balls. B. An increase in the price of tennis racquets. C. An increase in the expected future price of tennis balls. D. An increase in the price of the rubber used to make tennis balls.